US Debt and Bankruptcy

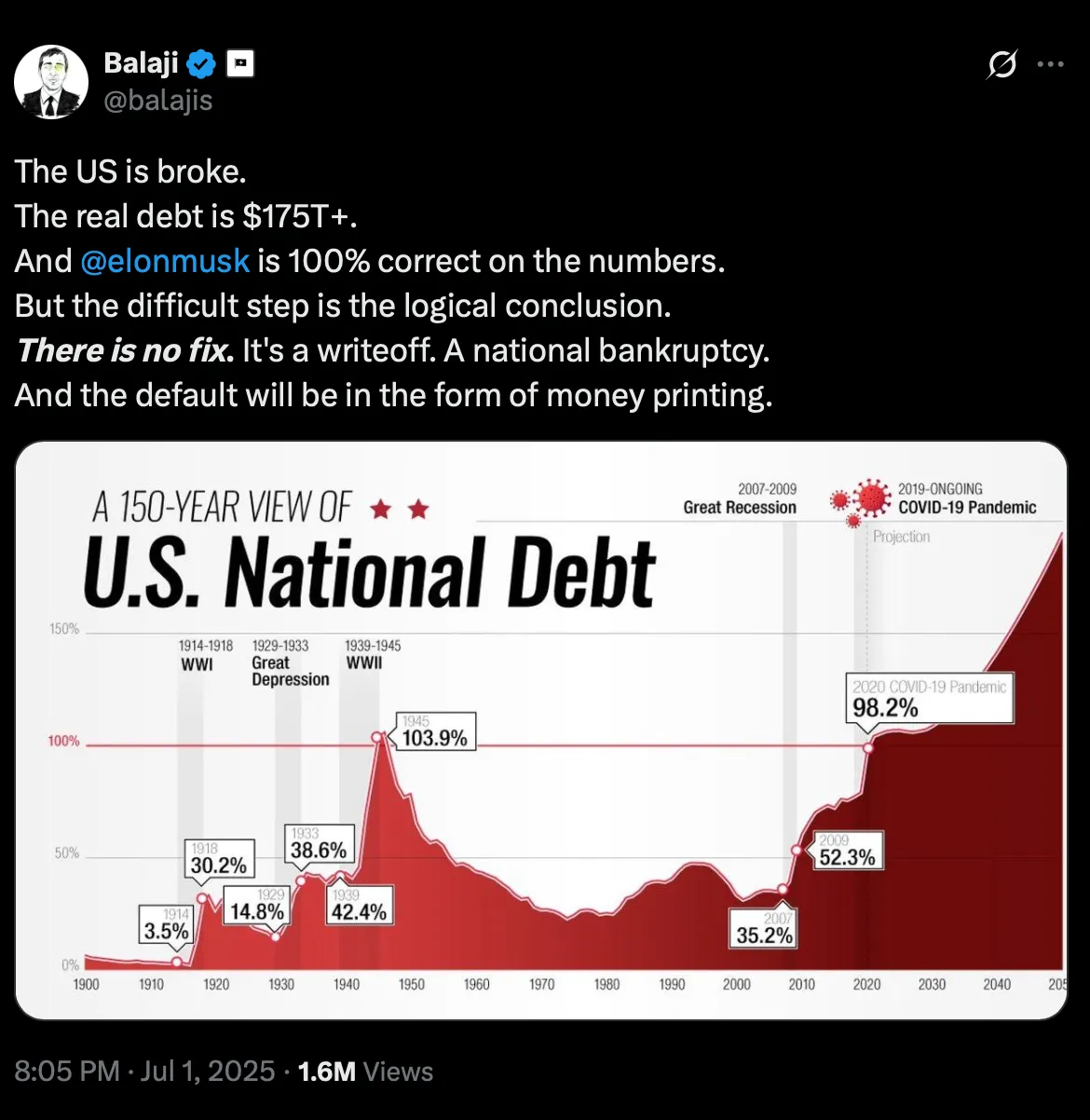

I am not an expert, but also trying to understand that problem. Because if the US is in trouble, we are all in trouble.

Correct me if I am wrong, but the term “debt” may be a bit misleading when applied to U.S. federal obligations:

- A large portion of this debt is held by Federal Reserve or US citizens. The government owes this money to itself and Americans.

- The US can not bankrupt in its own currency. It can always cover its “debt”. Check out the Japan case. The US can always meet obligations denominated in dollars by issuing more currency.

- It is more complex than that, but US treasuries are a form of money with interest. It is not a debt in the common sense of households or businesses. The US could literally pay off its debt today by issuing more dollars without interest, and the only meaningful risk would be inflation.

Inflation is the only real ceiling for the “debt” in the future (if it happens). But there are many ways to work around it.

Higher taxes and cutting social programs might not be the best choice to solve the issue. Taxes primarily serve to regulate inflation and redistribute wealth, not to cover the budget deficit. Since the budget is always financed through “money printing” first check out “Can Taxes and Bonds Finance Government Spending?” by Stephanie Bell, and only then do taxes try to keep up.

What would help is a better fiscal policy that targets infrastructure for example, or healthcare, and creates more jobs. Something where you could easily “print” more money, and it will be absorbed without impact on inflation. Creating a more balanced economy and maybe even deflationary pressure in some industries by boosting productivity and supply.

It is not that scary as it seems? Or what do I miss?

Inflation and credit rating

- Yes, 25% is “external” debt, but it is a minority. 75% is a lot, but it is the majority and owned domestically by the US itself. 25% is something that could be solved.

- There is no problem to pay the interest since it’s paid in the US-owned currency. The real constraint is inflation indeed, not ability to pay.

- Credit ratings don’t matter in case of the US. They are basically not relevant much for countries with monetary sovereignty.

I don’t see why others would care about the US inflation or credit rating. Also, there are many examples in the history when the US credit rating tanked, but investors still were buying their bonds.